The Biden administration has announced a significant reversal on its highly anticipated student loan forgiveness initiative, leaving millions of borrowers grappling with what this means for their financial futures. This sudden policy shift has sparked widespread debate and confusion across the nation.

What Happened?

The administration officially withdrew its proposal for broad student loan forgiveness after facing mounting legal challenges and criticism. The plan, which aimed to cancel up to $10,000 in federal student debt for individual borrowers earning less than $125,000 annually, faced opposition from multiple states and interest groups. Critics argued that the program exceeded the administration’s legal authority, and courts agreed in some cases, halting its implementation.

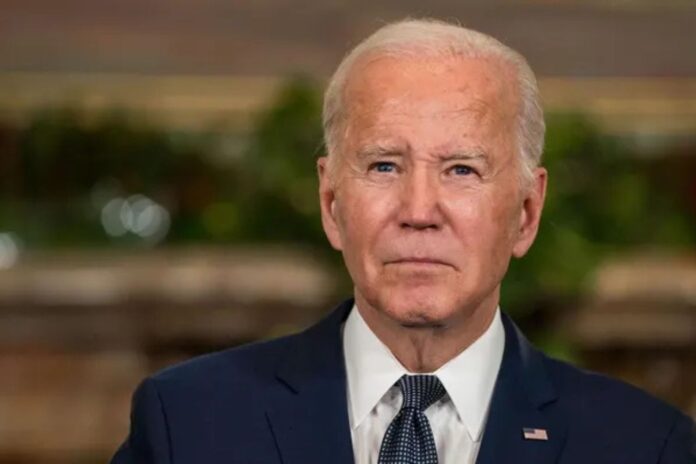

While the White House initially expressed confidence in the program’s legality, this withdrawal marks a significant setback in President Biden’s broader agenda to address the student debt crisis.

What Does This Mean for Borrowers?

Borrowers who were counting on this relief must now recalibrate their repayment plans. The pause on federal student loan payments, which had been extended multiple times since the start of the COVID-19 pandemic, officially ended in October 2023. Monthly payments and interest accrual have resumed, adding further financial strain for many.

For borrowers who applied for forgiveness during the program’s brief active period, the Department of Education has promised to keep their applications on file, though there’s no clear path forward for approval. Officials have urged borrowers to explore alternative federal relief options, such as income-driven repayment plans and public service loan forgiveness.

The Political Fallout

The withdrawal of this initiative is likely to become a major talking point in the 2024 presidential election. Republicans have criticized the plan as fiscally irresponsible, while progressive Democrats argue that broader debt cancellation is essential to address systemic inequities in higher education.

President Biden has vowed to continue fighting for student debt relief through alternative legislative and administrative routes, but the road ahead remains uncertain. Analysts suggest the administration may now shift focus to targeted forgiveness programs or push Congress to enact comprehensive debt relief legislation.

What Can Borrowers Do Now?

In light of this development, borrowers should:

- Review Repayment Plans: Ensure your loan repayment strategy aligns with your current financial situation. Federal programs like income-driven repayment (IDR) plans can significantly lower monthly payments.

- Check Eligibility for Targeted Forgiveness: Borrowers employed in public service or meeting specific criteria may still qualify for other forgiveness programs.

- Stay Informed: Keep an eye on updates from the Department of Education for any changes to student loan policies.

- Seek Financial Counseling: For borrowers struggling to make payments, financial advisors or nonprofit credit counseling agencies can provide valuable guidance.

Conclusion

This policy reversal underscores the complexity and controversy surrounding the student debt crisis in the United States. With over 43 million Americans collectively owing more than $1.7 trillion in student loans, the issue remains a pressing challenge for policymakers and borrowers alike.

As the Biden administration explores new avenues for relief, borrowers must stay proactive in managing their debt and advocating for systemic changes that address the root causes of the student loan burden. For now, the dream of widespread student loan forgiveness remains just that — a dream deferred.